New York City Home Financial Investment Opportunities: A Guide for Investors

New york city stays one of the most vibrant property markets worldwide, using diverse home investment opportunities for both neighborhood and international investors. With solid need, high rental yields, and long-term appreciation possibility, buying New York real estate can be a profitable venture. Below's a break down of the top financial investment chances and strategies to maximize your returns.

Why Invest in New York Real Estate?

High Need & Strong Market Security

New York's population growth and thriving economy make certain constant demand for property and commercial homes.

Minimal land accessibility drives property worth appreciation gradually.

Diverse Investment Options

From high-end condos in Manhattan to affordable multifamily systems in Brooklyn, the city offers a range of property types.

Opportunities expand beyond New York City to locations like Long Island, Westchester, and upstate New York.

Appealing Rental Market

With a solid rental demand, property managers can benefit from high occupancy prices and costs rental prices.

Temporary, mid-term, and lasting rental options permit versatile financial investment methods.

Ideal Locations for Building Financial Investment in New York City

Manhattan:

Ideal for high-end investor targeting high-net-worth customers and renters.

Commercial residential properties in economic areas offer steady returns.

Brooklyn:

A hub for young experts and families, making it excellent for property financial investments.

Gentrification remains to drive property gratitude and rental demand.

Queens:

Provides even more cost effective financial investment possibilities contrasted to Manhattan and Brooklyn.

Solid rental market as a result of its accessibility to major business hubs.

The Bronx:

Emerging financial investment hotspot with boosting advancement jobs.

Appealing for financiers trying to find budget-friendly multifamily and mixed-use residential properties.

Upstate New York City:

Cities like Buffalo, Albany, and Syracuse supply lower-cost financial investments with consistent rental earnings.

Ideal for investors looking for lasting admiration and much less competition.

Top Property Financial Investment Approaches

Get & Hold:

Purchase residential or commercial properties for long-term admiration and passive rental earnings.

Appropriate for investors that wish to build https://greenspringscapitalgroup.com equity over time.

Short-Term Rentals:

Leveraging systems like Airbnb can produce high returns, especially in tourist-heavy locations.

Guarantee compliance with neighborhood short-term rental regulations.

Multifamily Investments:

Duplexes and apartment offer steady capital and lower openings dangers.

Government rewards and tax breaks are readily available for budget friendly Green Springs Capital Group housing projects.

Take care of & Flip:

Purchase underestimated properties, remodel, and cost a greater price.

Calls for market knowledge and expertise to make sure profitable returns.

Industrial Real Estate:

Purchasing office, retail homes, or warehouses can supply secure, long-term lessees.

Great for investors trying to find diversity outside houses.

Secret Considerations for New York City Property Investors

Market Trends & Laws:

Keep informed about zoning legislations, rent out stabilization policies, and real estate tax adjustments.

Research present need and supply characteristics in different neighborhoods.

Financing Options:

Take into consideration mortgage loans, private financing, and crowdfunding systems to money investments.

Compare rate of interest and loan terms to take full advantage of earnings.

Building Management:

Hiring professional home supervisors can enhance procedures and lessee relationships.

For out-of-state capitalists, a reliable management team is important.

Tax Implications:

Understanding local tax policies can help maximize deductions and improve internet returns.

Seek advice from a property tax expert for individualized methods.

New york https://greenspringscapitalgroup.com city provides a wealth of residential or commercial property investment opportunities, from premium condominiums in Manhattan to growing rural markets in Upstate New York. With strategic preparation, complete market research, and the best financial investment technique, real estate investors can secure lasting earnings in one of the world's most desired residential property markets.

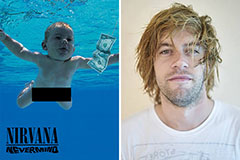

Spencer Elden Then & Now!

Spencer Elden Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now!